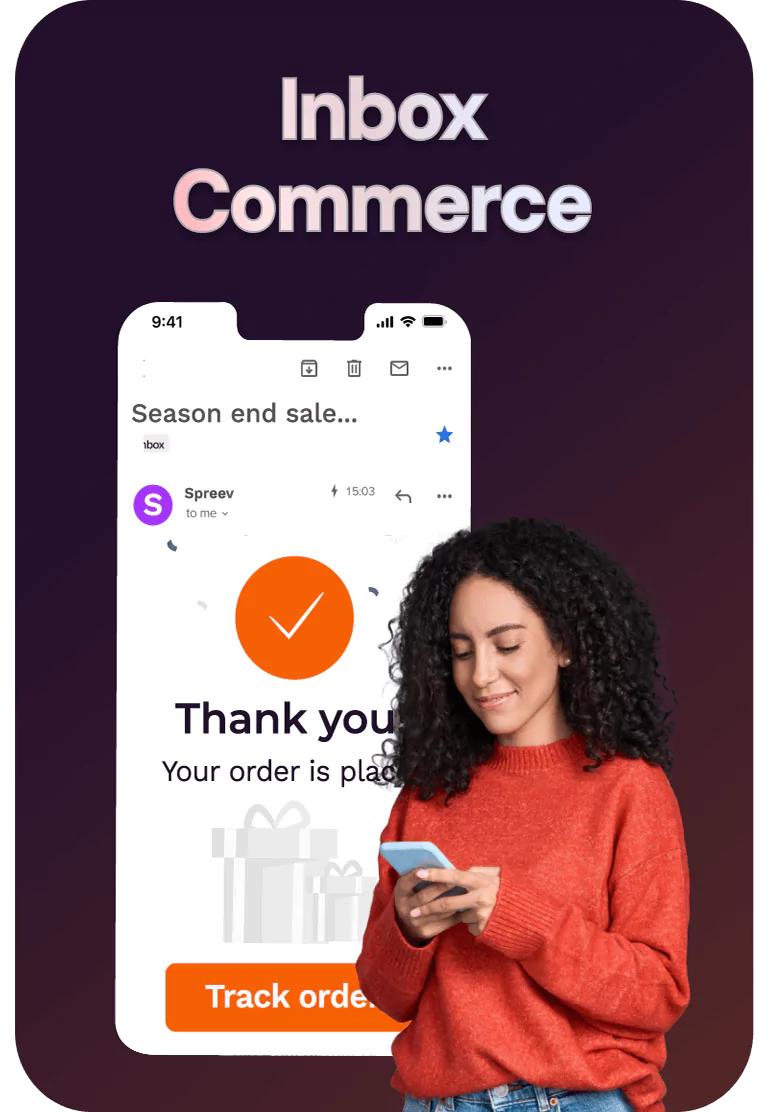

The MarTech OS for your

Profitable Growth

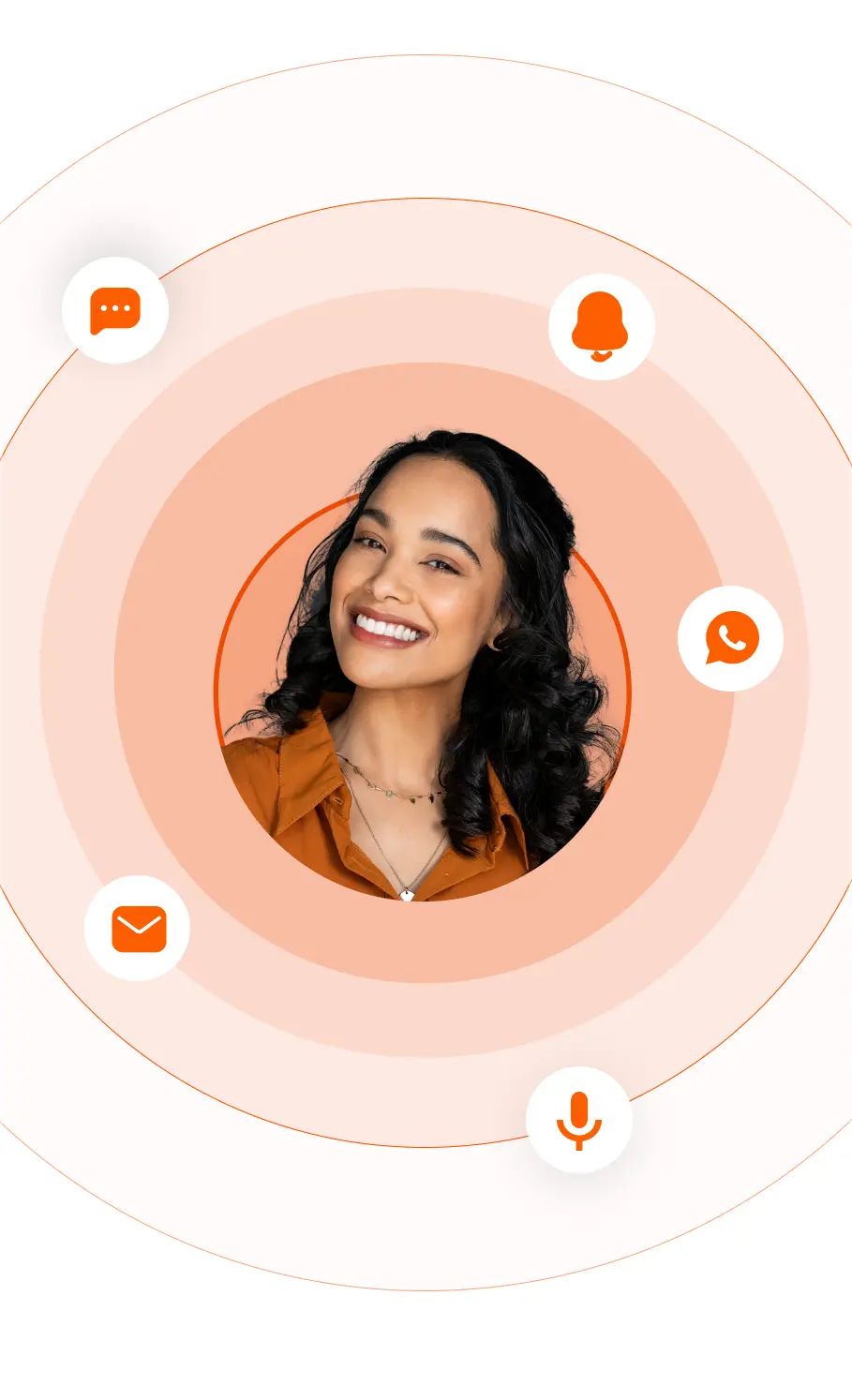

Empowering marketers to create meaningful customer connections through our

AI-powered Customer Experience and Personalization platform

An all-in-one platform with the customer at its core

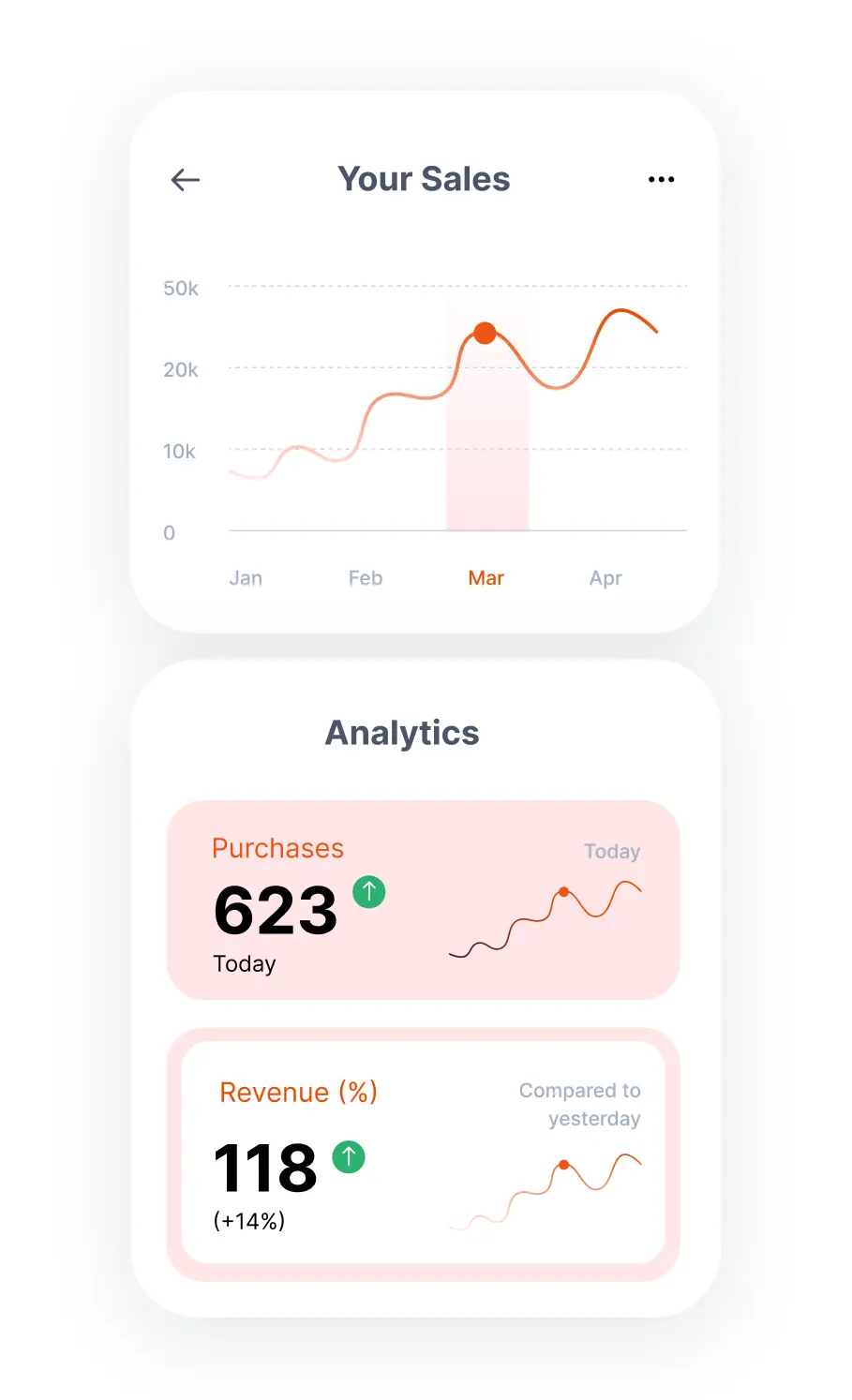

Global scale that you can count on

50 Bn

Notifications/month

35 Bn

Emails/month

30 Bn

Searches/month

200 Mn

WhatsApp/month

We don’t just do it all.

We do it best.

Sameer Jain

VP & Head D2C (India)

Neeraj Singh Dev

EVP of Ecommerce (India)

Satyadev Sarvaiya

Head of Churn, Upsell and CX Management

Lavanya Nalli

Vice Chairman

Wilson Dsouza

Head of Marketing

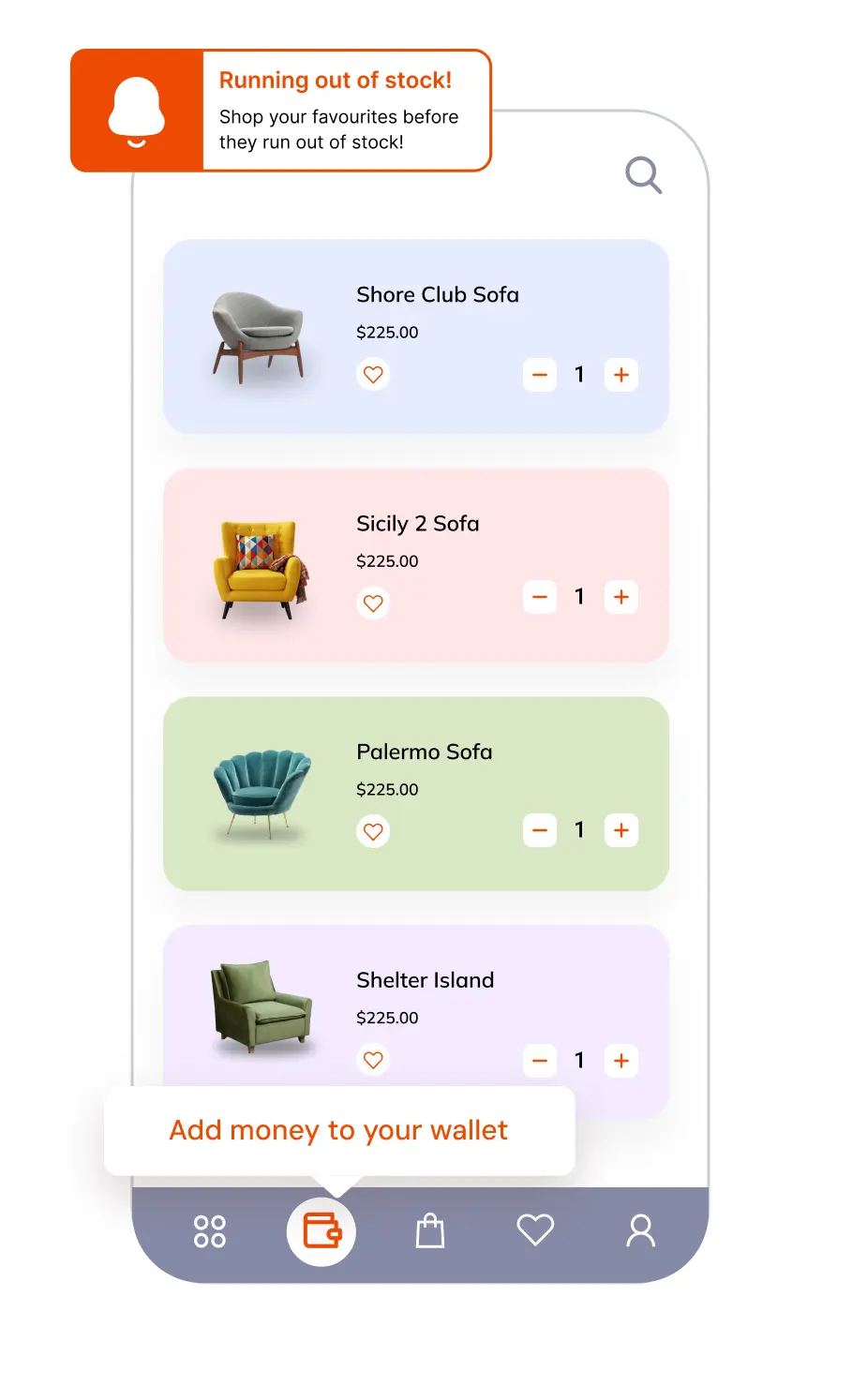

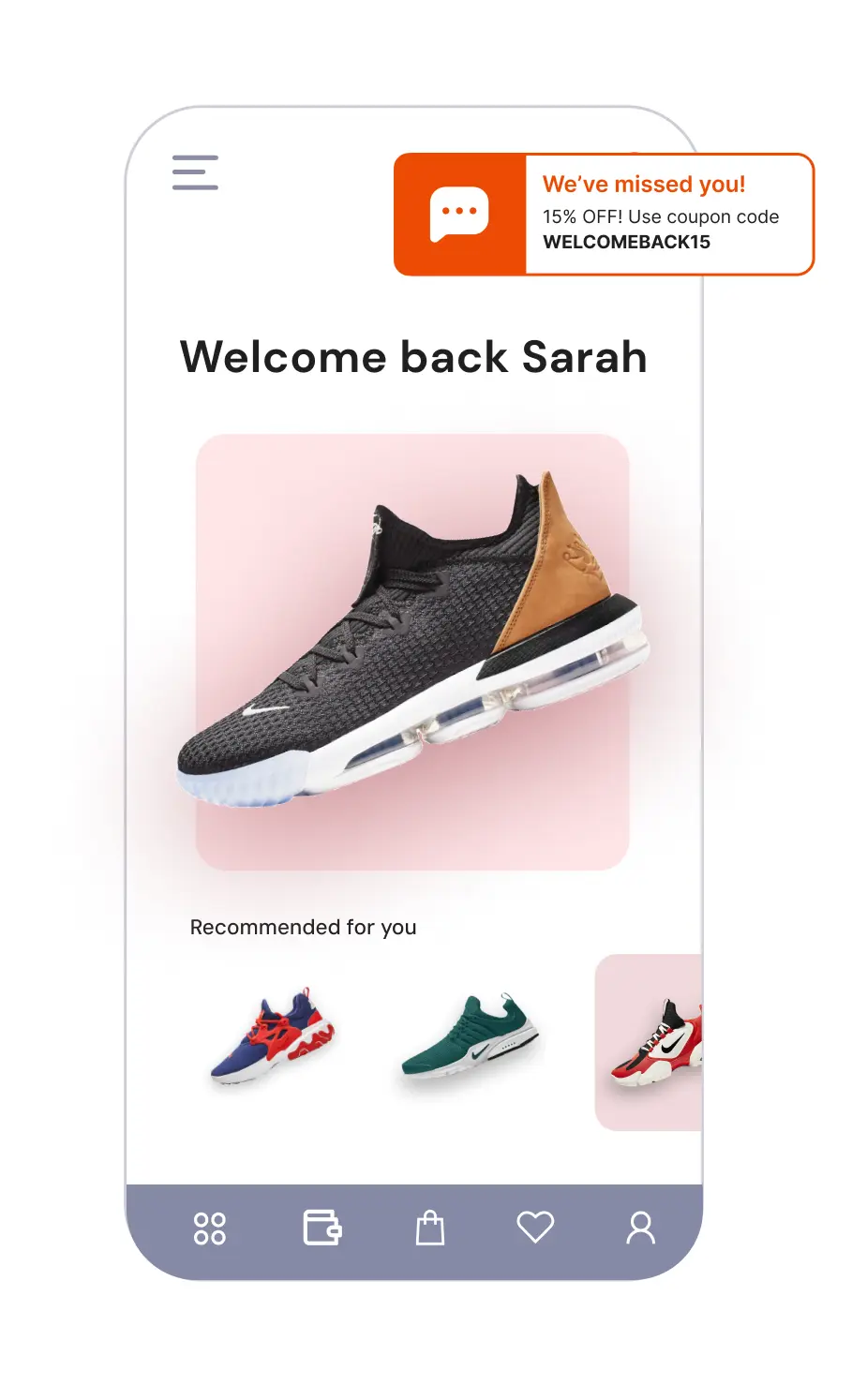

If the shoe fits, we help you sell it better.

This isn't meant to be a part of your

user journey!

With us, your customers will see exactly what you want them to see and where you want them to see it.